DISCIPLINED.

PRECISE.

TRUSTWORTHY.

Enhanced Asset Management’s refined investment process and market-beating track record speak for themselves.

80 years combined EXPERIENCE

“Very few people dedicate their entire working lives to the sole pursuit of investing in the markets. With an open mind, a discipline of constant learning, and an unwavering focus, we’ve shaped outcomes over time that we’re proud to say rank among the strongest long-term track records in the country. This isn’t luck. It’s the result of precision, consistency, and a relentless commitment to doing one thing exceptionally well.”

Russell Muldoon, Portfolio Manager

WAYS TO INVEST WITH ENHANCED ASSET MANAGEMENT

CONCENTRATED PORTFOLIO

A high-conviction portfolio of quality, growth-focused businesses, our best ideas, carefully selected to deliver long-term performance potential.

MODEL PORTFOLIOS

Broad exposure across asset classes and regions, designed to deliver consistent long-term growth with value-enhancing active management.

Wealth isn’t built by chance — it’s built by conviction.

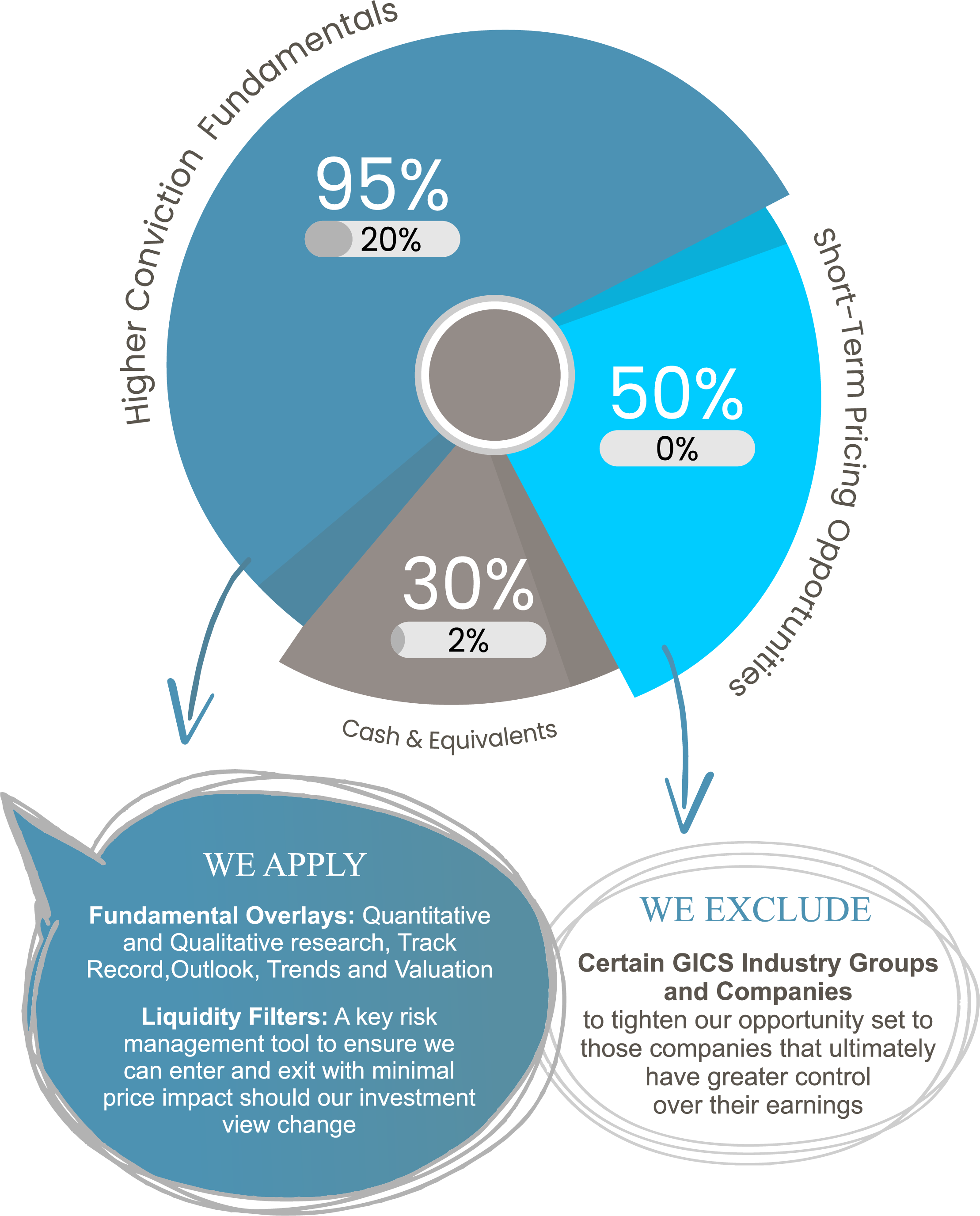

At Enhanced Asset Management, we invest in great businesses with bright futures, using two complementary strategies designed to deliver long-term growth and resilience.

1. HIGH CONVICTION STRATEGY

We back exceptional businesses — those with strong, compounding earnings, solid balance sheets, and powerful industry tailwinds. We invest only when long-term returns are truly compelling.

2. Trading & Strong Demand Strategy

Markets don’t always behave rationally. Even outstanding companies can trade at premiums to fair value. We actively manage these positions, realising value when share prices fully reflect future growth potential.