HOW WE INVEST

Solid foundations inspiring long-term investment performance

At Enhanced Asset Management, we believe wealth isn’t built by chance, it’s built by owning great businesses with bright futures. That’s why in our Concentrated Australian Equity Portfolio, we focus on quality companies we know inside and out. These are businesses growing their earnings, expanding their opportunities and compounding value year after year. We back them with confidence because we believe they can deliver meaningful long-term results.

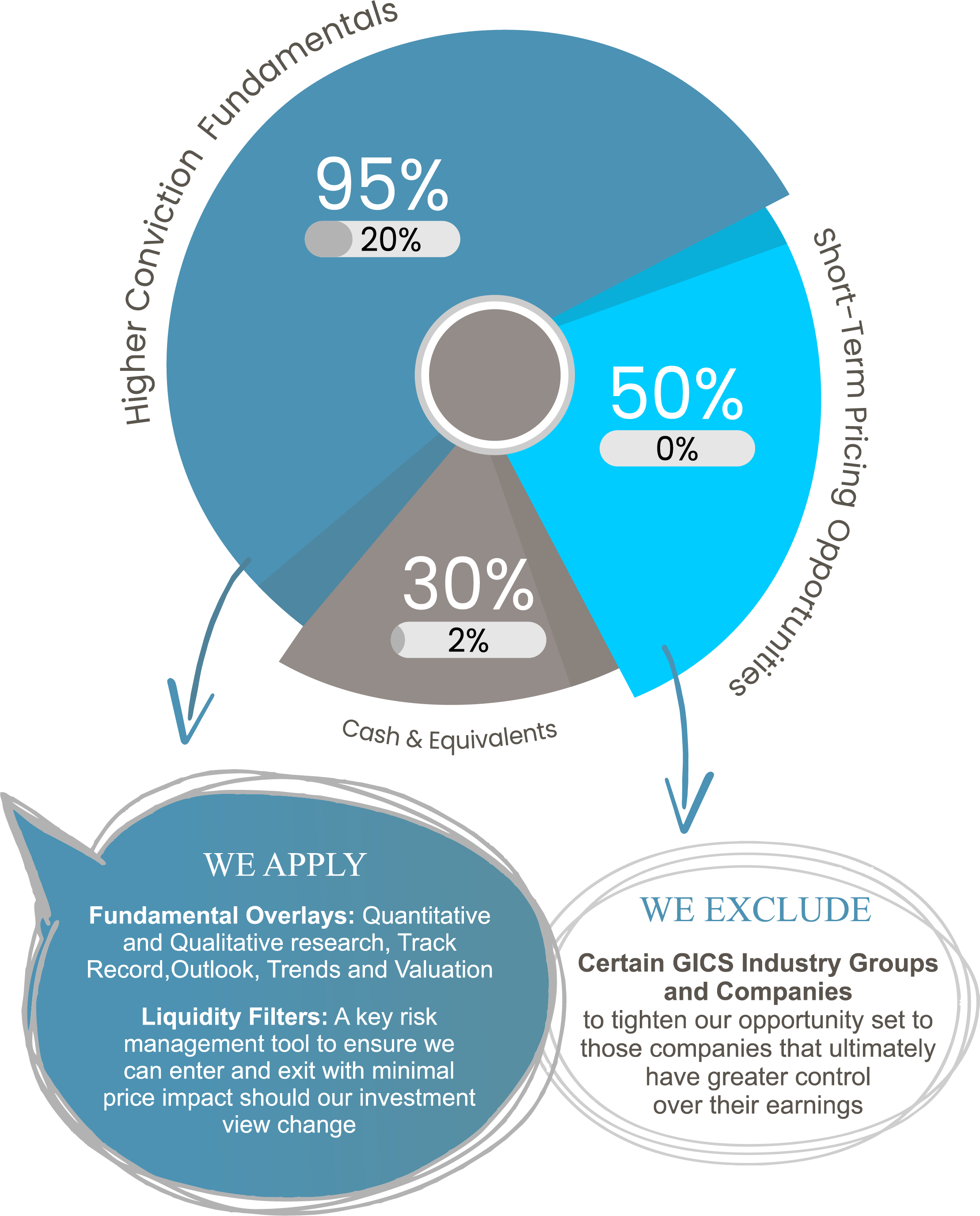

Our flagship Concentrated Australian Equity Portfolio reflects this philosophy. It’s deliberately selective, holding a concentrated mix of our best ideas, those we believe have the greatest potential of creating value. From time to time, when opportunities arise, we step outside that framework to capture shorter-term gains; however, the approach remains the same: protect capital, grow capital, and avoid permanent loss. For us, the return of capital is just as important as the return on capital.

Risk management sits at the heart of our process and in times of market stress, which is a feature of markets that is out of our control, we can ring-fence up to 30% of assets, holding them in cash or hedging them for protection. This safety net allows us to stay focused on what matters most: pursuing absolute returns through active, conviction-led investing, whilst having a war-chest ready to deploy and uplift the quality of our holdings even further. And over time, our track record shows that this combination of discipline and decisiveness delivers real outperformance against the benchmark.

We bring the same mindset to our Model Portfolios, where we broaden the philosophy across asset classes and geographies. These portfolios are designed to spread risk intelligently, while still seeking out opportunities to own high-quality businesses that can enhance returns. The aim is simple: to give clients confidence that their capital is positioned to be resilient and rewarding, in good markets and in tough ones.

Enhanced Asset Management’s Conservative, Balanced, Growth, and High Growth Model Portfolios form the foundation. They are anchored in low-cost, strategically allocated exchange-traded funds that track global indices, ensuring clients always capture market returns at a minimum. But we don’t stop there. When we see compelling opportunities in small and mid-cap Australian equities, we act decisively, adding another layer of potential growth.

At every step, our philosophy is clear: invest with conviction, protect against downside, and give our clients the confidence that their wealth is being built with discipline and care.