INVEST

ENHANCED ASSET MANAGEMENT Concentrated Australian Equity Portfolio

The stock market isn’t just where we work, it’s where we live and breathe. For more than two decades, we’ve been immersed in the rhythm of Australian equities, studying the companies that shape our economy and the entrepreneurs who dare to change it. Out of this passion came our flagship opportunity: the Enhanced Asset Management Concentrated Australian Equity Portfolio.

The Concentrated Australian Equity Portfolio was born from conviction, conviction that the best way to build lasting wealth is to own extraordinary businesses and to back them when it matters most. For high-net-worth investors, it’s an invitation to share in a strategy crafted from years of market-tested experience, discipline, and relentless pursuit of performance.

At the heart of the process is a simple belief: not all companies deserve your capital. We apply a rigorous bottom-up screening process to strip away the noise and exclude the mediocre. What remains is the fertile ground where Australia’s most compelling businesses grow. From there, we dive deeper, blending hard data with human insight to uncover the opportunities.

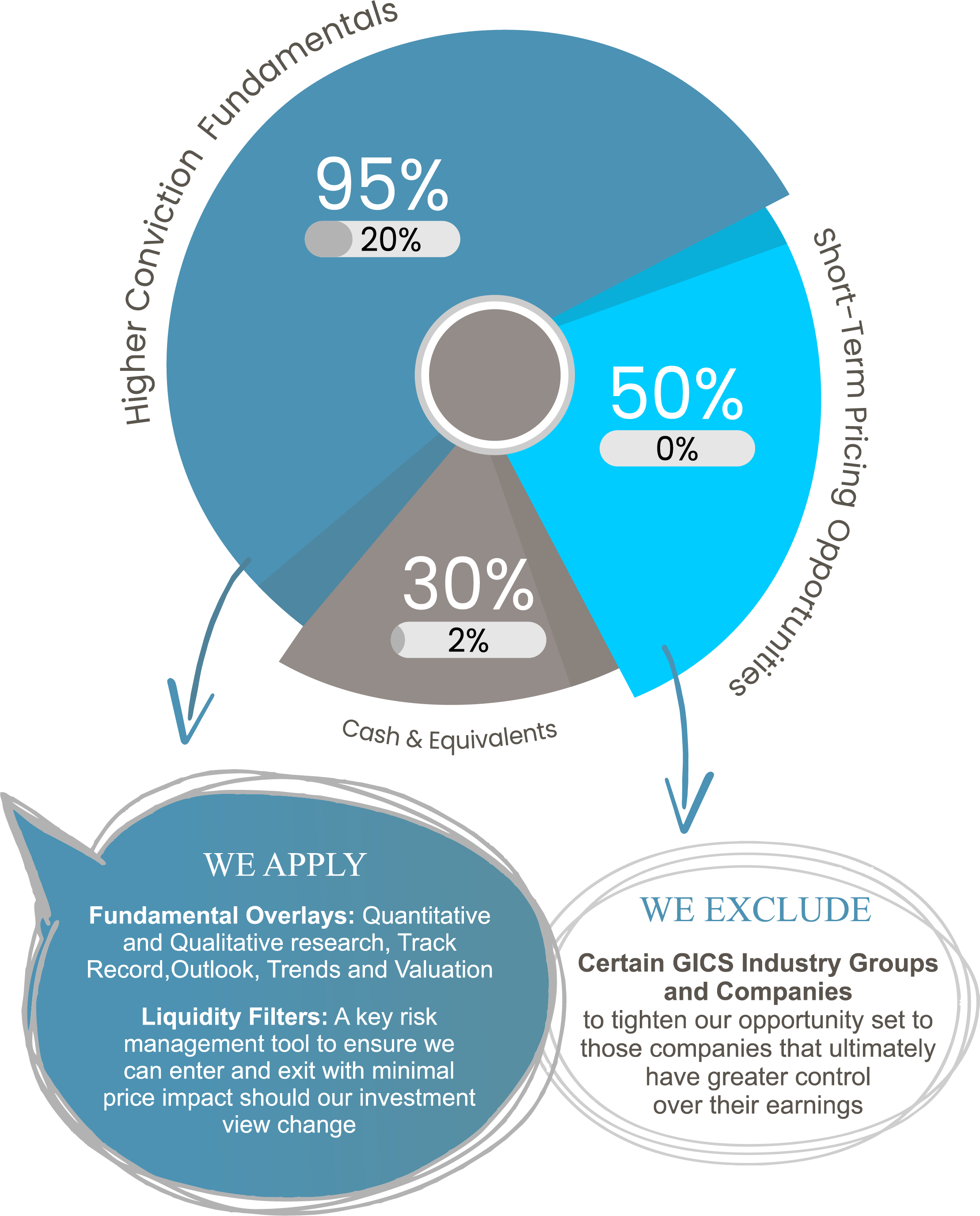

The Concentrated Australian Equity Portfolio is managed through two complementary strategies.

1. High Conviction Strategy

Here we focus on businesses with genuine strength: companies with earnings growth that compounds, balance sheets that protect, and industry tailwinds that propel them forward. We apply valuation discipline, ensuring we only invest when long-term returns are truly compelling.

2. Trading & Strong Demand StrategY

Australia’s best growth companies often command premium valuations, and we have learnt that the market won’t always yield to our valuations work. Guided by qualitative characteristics and overlaid with quantitative tools, we actively trade high-growth businesses with strong market demand, capturing opportunities where the future is being built.

Together, these strategies create a balance between discipline and dynamism. It’s an approach that protects capital in the tough times, and accelerates growth in the good — always with the aim of delivering superior, risk-adjusted returns.

For us, the Enhanced Asset Management Concentrated Australian Equity Portfolio is more than a product. It’s the culmination of years of obsession, refinement, and an unwavering commitment to excellence.

For you, it’s an opportunity to invest with managers who don’t just watch the market, they live it.

Key Facts

Enhanced Asset Management Concentrated Australian Equity Portfolio Key Facts

| Feature | Description | |

|---|---|---|

| Portfolio Name | Enhanced Asset Management Concentrated Australian Equity Portfolio | |

| Investment Manager | Enhanced Asset Management | |

| Portfolio Managers | Russell Muldoon and Bowen Hosking | |

| Investment Objective | To deliver superior positive returns above the S&P/ASX 200 Total Return Index over 7+ years. | |

| Benchmark | S&P/ASX 200 Total Return Index | |

| Stock Holdings | 10 - 30 | |

| Investor Eligibility | Wholesale or Sophisticated Only | |

| Minimum Investment | $50,000 | |

| Suggested Time Frame | 7+ years |

Your investment manager's values are anchored in

growth

We are committed to long-term, sustainable wealth creation for our clients. Through a portfolio of either concentrated high-quality businesses or diversified exposures across asset classes, we aim to deliver growth that compounds meaningfully over time.

TRUST

Trust is the foundation of our client relationships. We act with integrity and transparency, ensuring our interests remain aligned with those of our investors, and honouring the responsibility of managing wealth across generations.

PRECISION

Every decision we make is backed by disciplined research and a proven investment process. We apply rigorous analysis to ensure portfolios are positioned with clarity and conviction.

VALUE ENHANCEMENT

Our goal is to add measurable value through thoughtful portfolio construction and active management. We are dedicated to delivering first-class outcomes over the long term.

We invest alongside you, for the long term

Why invest in the Concentrated Australian Equity Portfolio?

A fee model built for investors, not managers

We believe investors should only pay for real value. That’s why our Management Fee of just 0.77% sits well below many industry peers, some of whom charge as much as 2.5% and performance fees over esoteric and low-hurdle benchmarks (Small Ordinaries Index and cash, for example). If we don't beat the entire market, no performance is paid. Our success is tied directly to yours.

Direct access to your portfolio managers

We live and breathe the stock market and we love talking about it. With Enhanced, you’re not kept at arm’s length. You have open access to the very people managing your capital. Whether it’s a conversation about an idea, a question about the market, or simply sharing perspectives, our door (and inbox) is always open.

A track record that speaks for itself

We’ve built one of the strongest long-term track records in Australia. This wasn’t achieved by chance. It’s the product of integrity, discipline, and a relentless commitment to aligning our interests with yours. We invest with conviction, protect against permanent loss where possible, and stay focused on delivering genuine outcomes.

Other ways to invest with Enhanced Asset Management

Our Portfolio Managers also oversee four fully invested, broadly diversified Model Portfolios: Conservative, Balanced, Growth, and High Growth, each anchored in low-cost, exchange-traded funds (ETFs). These portfolios are designed to deliver at least market returns as a foundation.

But we don’t stop there. Unlike traditional ETFs, our Investment Managers actively seek to enhance outcomes by selectively investing in small and mid-cap Australian equities within each Model Portfolio. This is where our expertise adds value beyond the Index, and why the name says it all: Enhanced Asset Management.