PERFORMANCE

Concentrated Australian Equity Portfolio performance REPORTS

Explore past performance and read the latest Reports for the Enhanced Asset Management Concentrated Australian Equity Portfolio.

| Portfolio and Benchmark | 3 Months | 6 Months | 1 Year | Since Inception# (p.a.) |

|---|---|---|---|---|

| Concentrated Australian Equity Portfolio | 9.62% | 26.13% | 24.21% | 23.80% |

| S&P/ASX 200 Total Return Index | 4.71% (+4.91%) | 14.66% (+11.47%) | 10.56% (+13.65%) | 12.57% (+11.23%) |

* Data as at 31 December 2025 #Inception Date: 1 September 2024

Unless otherwise stated, all performance figures are provided net of fees and are on a pre-tax basis. The information has been prepared for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs. You should obtain and consider a copy of the Managed Portfolio Disclosure Document(s) relating to Enhanced Asset Management’s Portfolios before making a decision to invest.

While the information has been prepared with all reasonable care, Enhanced Asset Management (Enhanced) makes no representation or warranty as to the accuracy or completeness of any statement in this information, including any forecasts, nor does Enhanced guarantee the performance of the Portfolios or the repayment of any investor’s capital. To the extent permitted by law, neither Enhanced, including their employees, consultants, advisers, officers or authorised representatives, are liable for any loss or damage arising as a result of reliance placed on the contents of this report. Past performance is not indicative of future performance.

This report was prepared by Enhanced Asset Management (‘Enhanced’). ABN 65 635 499 857. Corporate Authorised Representative of Oreana Financial Services Ltd ABN 91 607 515 122 (CAR 1278093). Australian Financial Services Licensee No. 482234

2025 REPORTS

Wealth isn’t built by chance — it’s built by conviction.

At Enhanced Asset Management, we invest in great businesses with bright futures, using two complementary strategies designed to deliver long-term growth and resilience.

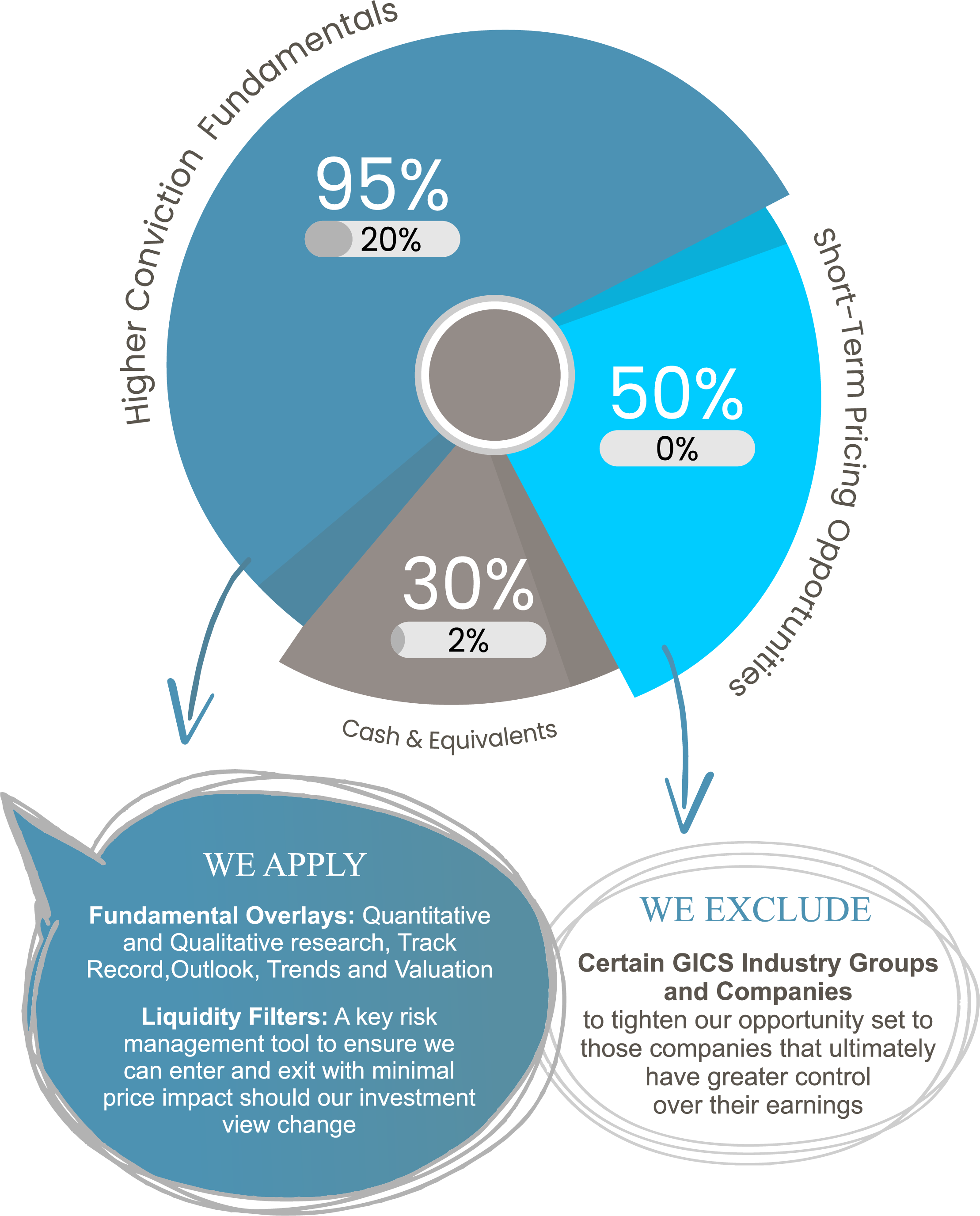

1. HIGH CONVICTION STRATEGY

We back exceptional businesses — those with strong, compounding earnings, solid balance sheets, and powerful industry tailwinds. We invest only when long-term returns are truly compelling.

2. Trading & Strong Demand Strategy

Markets don’t always behave rationally. Even outstanding companies can trade at premiums to fair value. We actively manage these positions, realising value when share prices fully reflect future growth potential.